-balance-by-age-group.jpg?sfvrsn=0)

Saving for retirement is an important financial goal, and ideally, your nest egg should follow a steady upward trajectory over time. As you save, it can be helpful to have a benchmark for tracking your progress. For instance, you might compare your savings against the average retirement savings for

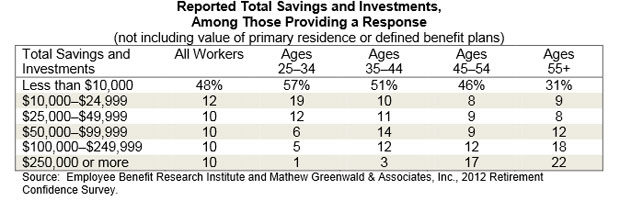

We compute the average and median retirement savings for United States households using 2016 SCF data. Definitions include strict savings like IRAs and 401(k)s as well as expansive savings in other accounts.

What’s the average salary by age? According to the Bureau of Labor Statistics, the average salary of 35-to-44-s is $49,400 per year. But earnings

Find out what the average retirement savings are for your age, how much you should have and what you can do to boost your savings.

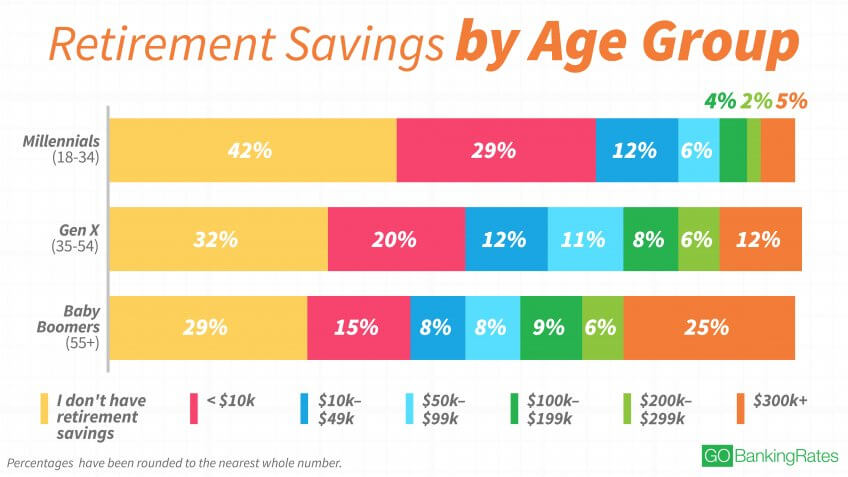

What people in various age groups have saved at present for their retirement years — and where they should be. How does your nest egg compare?

Survey: How Much Americans Have Saved for Retirement. The GoBankingRates survey was conducted as three Google Consumer Surveys, each targeted at one of three age groups: millennials, Generation Xers, and baby boomers and seniors.

Report to the Ranking Member, Health, Education, Labor, and Pensions, RETIREMENT SECURITY Most Households Approaching Retirement Have Low Savings

Statistics showing the average retirement savings by age are sobering. Studies have shown that people are becoming less likely to save for retirement.

Want to know how you stack up for average retirement savings by age group? Visit retirement income blog to see the data and learn if you’re ahead or behind.